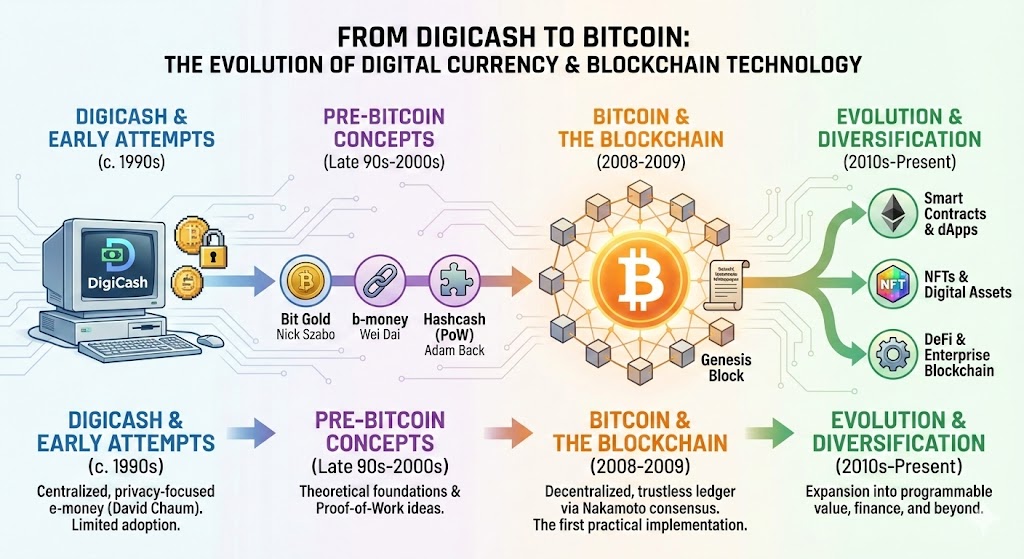

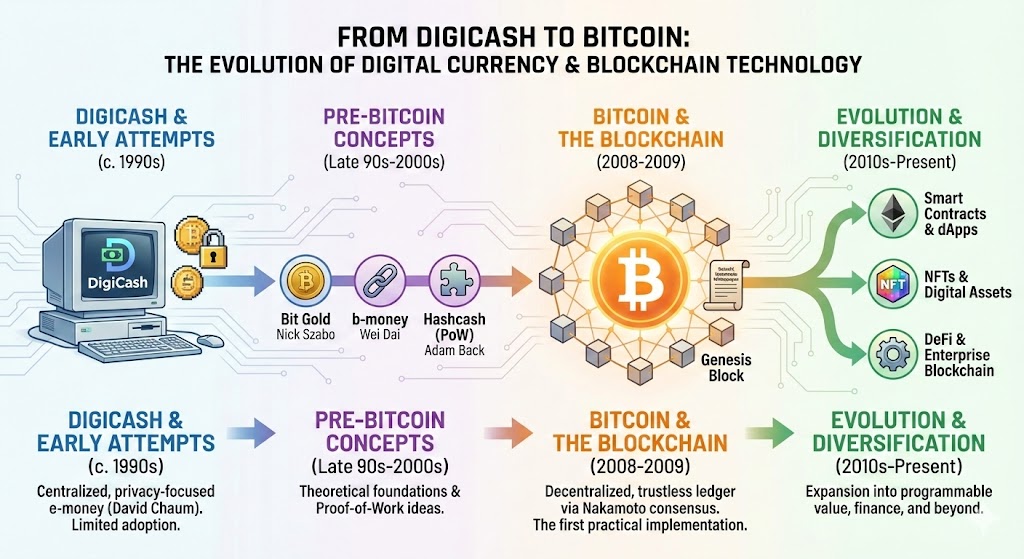

Before Bitcoin became a trend, there was DigiCash, Hashcash, b-money, and Bit Gold, ideas that laid the groundwork for the decentralized financial revolution. In this article, we will walk you through the evolution of digital currency, tying it all to the rise of Bitcoin and blockchain technology.

Introduction

Before the world was abuzz with NFTs, crypto wallets, and Bitcoin millionaires, a quiet revolution was already brewing in the tech corners of the early internet. Long before Satoshi Nakamoto published the now-famous Bitcoin whitepaper in 2008, there were bold thinkers and groundbreaking concepts that laid the very foundations of digital money.

Names like DigiCash, Hashcash, b-money, and Bit Gold might not be as mainstream as Bitcoin today, but they were the stepping stones in a decades-long journey toward decentralized digital currency.

In this article, we will go through the history of these early innovations, how they inspired the creation of Bitcoin, and how blockchain technology ties it all together, making waves across finance, education, and global systems today.

DigiCash (1990s): The First Big Step Toward Digital Money

What was DigiCash?

DigiCash was the brainchild of David Chaum, a cryptographer and privacy advocate who, in the 1980s, saw the need for secure, anonymous digital payments. He founded DigiCash in 1989 with the idea of creating a currency that could be transferred online, like cash in your pocket, but without leaving a trace.

His system used a technique called blind signatures, which allowed users to make transactions without the bank or any third party knowing who sent or received the money.

Sounds kind of like Bitcoin, right?

Why it mattered:

- First implementation of privacy-preserving digital payments

- Introduced cryptographic techniques that are still relevant today

- Had partnerships with banks (including trials with Deutsche Bank)

Why it failed:

- It wasn’t decentralized. DigiCash required users to trust a central company.

- Adoption was slow, people weren’t quite ready for digital money.

- The company went bankrupt in 1998.

Though DigiCash didn’t last, it sparked a fire in the cryptographic community. The idea of digital cash without the need for intermediaries was officially on the table.

Hashcash (1997): Proof of Work is Born

Next came Hashcash, created by British cryptographer Adam Back in 1997. This wasn’t a currency, but rather a mechanism, one that would become essential to Bitcoin’s DNA.

What was Hashcash?

Originally designed to fight email spam, Hashcash used a concept called proof-of-work. Before someone could send an email, their computer had to solve a small puzzle—nothing heavy, but just enough to discourage spammy behavior.

Key contribution:

- Proof-of-Work (PoW): A mechanism that requires computational effort before an action can be accepted by a network.

Bitcoin uses this exact concept today to validate transactions and secure the blockchain.

b-money (1998): The Unofficial Blueprint for Bitcoin

A proposal made by Wei Dai, another pioneering mind in the crypto space.

What was b-money?

It was a theoretical framework for an anonymous, distributed digital currency system. The idea? Let users manage their own accounts, without any central authority. Transactions would be verified by a network of peers, and the system would rely on cryptographic contracts.

Sound familiar? That’s because b-money reads like a rough draft of Bitcoin.

Key ideas:

- Decentralization

- Use of cryptographic identities

- A ledger maintained by the participants—not a central server

Although b-money was never implemented, Satoshi Nakamoto directly cited Wei Dai in the Bitcoin whitepaper.

Bit Gold (1998–2005): The Closest Predecessor to Bitcoin

Finally, we arrive at Bit Gold, created by Nick Szabo, a computer scientist and legal scholar who’s often rumored (though never confirmed) to be Satoshi Nakamoto himself.

What was Bit Gold?

Bit Gold was designed as a decentralized, inflation-resistant digital currency. Like Hashcash, it used proof-of-work puzzles, but it added a crucial twist: each solution was linked in a chain, just like blockchain.

It even proposed a timestamped ledger, where the history of all transactions would be recorded and publicly verifiable. You can see the pieces coming together now, can’t you?

Innovations:

- Chained PoW solutions (proto-blockchain)

- Decentralized minting of new coins

- Public record of all transactions

Though Bit Gold never launched, it was a huge influence on what came next.

Bitcoin (2009): The Synthesis of It All

Then came Bitcoin, the first successful implementation of a peer-to-peer digital cash system.

In 2008, a mysterious figure known as Satoshi Nakamoto published the Bitcoin whitepaper, referencing both Wei Dai (b-money) and Adam Back (Hashcash). Satoshi essentially took the best ideas from:

- DigiCash’s privacy focus

- Hashcash’s proof-of-work

- b-money’s decentralized ledger

- Bit Gold’s timestamped chain of records

And packaged them into one elegant solution: Bitcoin.

Bitcoin’s Key Innovations:

- Blockchain: A public ledger of all transactions, secured through cryptography

- Decentralization: No central bank, no single point of control

- Proof-of-work: Ensures security and fairness

- Limited supply: Only 21 million coins will ever exist, making it deflationary

Bitcoin marked the birth of blockchain technology, and the world has never been the same since.

Why Did Bitcoin Succeed When Others Failed?

Bitcoin’s success wasn’t just a lucky break or perfect timing (though that helped too). It succeeded because it solved multiple problems that earlier digital currencies like DigiCash, Hashcash, b-money, and Bit Gold couldn’t crack all at once.

Let’s break it down.

1. True Decentralization: No Central Authority, No Single Point of Failure

Earlier digital currency projects like DigiCash relied on centralized companies or banks to manage and issue currency. That meant users still had to trust a third party—kind of defeating the purpose of “digital cash.”

Bitcoin flipped the script by running on a peer-to-peer network where:

- No one person or group controls the system

- Anyone can join and verify transactions

- The system runs on code, not corporate policies

This decentralized structure made Bitcoin more resilient, censorship-resistant, and trustless users don’t have to “trust” anyone, they just verify.

2. Incentives: Miners Get Paid to Secure the Network

Bitcoin introduced a clever incentive model that earlier systems lacked.

Using Proof-of-Work (PoW) (a concept borrowed from Hashcash), Bitcoin rewards miners with new BTC every time they successfully validate a block of transactions.

Why it matters:

- People are financially motivated to keep the network running

- The system bootstrapped its own security through economics

- It created a self-sustaining ecosystem without needing a company behind it

This was a big deal. Projects like b-money and Bit Gold didn’t fully work out the incentive structure. Bitcoin did.

3. Scarcity and Trustless Monetary Policy

Satoshi designed Bitcoin to be deflationary, with a hard cap of 21 million coins.

Why that’s important:

- Unlike fiat currencies, Bitcoin can’t be inflated or manipulated by governments

- The rules are enforced by the network itself—not a central bank

- Everyone can see and verify the code and total supply

That level of predictability and transparency gave Bitcoin strong appeal, especially in times of financial instability (like the 2008 crash).

4. Blockchain: A Transparent, Immutable Ledger

The blockchain isn’t just tech jargon, it’s the game-changer.

By recording every transaction publicly, in blocks that are chained together, Bitcoin:

- Made it nearly impossible to cheat the system

- Ensured full transparency

- Enabled verifiable history without needing a third-party accountant or bank

Earlier attempts like Bit Gold had similar ideas, but Bitcoin was the first to put it all together and launch it successfully.

5. Perfect Timing: A Response to the 2008 Financial Crisis

The launch of Bitcoin in January 2009 wasn’t a coincidence.

The 2008 global financial crisis had just shaken trust in traditional banking. People were furious about:

- Bank bailouts

- Government bailouts

- Central bank money printing

Bitcoin’s genesis block even includes a message referencing a newspaper headline:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

This message was a powerful ideological statement, and it resonated deeply with tech communities, libertarians, and eventually, the mainstream.

6. Open Source & Community Driven

Bitcoin wasn’t locked away in some corporate lab. It was released as open-source software, meaning anyone could:

- Read the code

- Contribute improvements

- Build services around it (wallets, exchanges, apps)

This created a massive global developer community and an ecosystem of innovation around Bitcoin and its technology.

7. Network Effect: The First to Gain Widespread Adoption

Simply put: first-mover advantage.

As more people started using Bitcoin:

- Its value increased

- More businesses accepted it

- More developers built tools around it

- More media started covering it

This compounding momentum created a feedback loop that early projects like DigiCash and Bit Gold never achieved.

How Blockchain Ties It All Together

Blockchain isn’t just for Bitcoin anymore. It’s a transformational technology that’s now being used in:

- Education: Issuing verifiable digital diplomas and certificates

- Healthcare: Securing patient records across systems

- Finance: Powering smart contracts, DeFi, and cross-border payments

- Supply Chains: Tracking products from source to consumer

The common thread? Trust without intermediaries.

Just as DigiCash dreamed of removing banks from online payments, blockchain is removing middlemen from all kinds of systems, making them more secure, efficient, and fair.

Why This Matters for Intercultural and Global Collaboration

At London Intercultural Academy, we explore the intersection of technology, culture, and global cooperation. The evolution from DigiCash to Bitcoin is a powerful example of:

- Decentralized innovation beyond borders

- Empowering individuals with equal access to tools

- Creating global standards for transparency and trust

From Chaum’s DigiCash to Nakamoto’s Bitcoin, the history of digital currency is a tale of visionaries building upon one another, each taking a swing at solving the age-old problem: How do we create money we can trust online, without trusting anyone?

And with blockchain paving the way for a more decentralized and transparent world, this journey is far from over.

FAQs

Q: Was Bitcoin the first digital currency?

Nope! Ideas like DigiCash, b-money, and Bit Gold came before. But Bitcoin was the first to successfully combine key technologies into a decentralized system that actually worked.

Q: Who is Satoshi Nakamoto?

That’s still a mystery! Many speculate (Nick Szabo? Hal Finney?) but no one knows for sure.

Q: How does blockchain relate to digital currency?

Blockchain is the underlying tech that makes digital currencies like Bitcoin possible. It’s a distributed ledger that keeps all transactions secure and transparent.

Q: Can blockchain be used outside of finance?

Absolutely! Education, healthcare, law, art, you name it. Blockchain’s transparency and security have wide applications.

Recommended External Reads

- Bitcoin Whitepaper by Satoshi Nakamoto

- History of DigiCash – Investopedia

- Nick Szabo’s Bit Gold Proposal

- Blockchain and Education – UNESCO Report