Introduction: Why Culture Is the Silent Force Shaping Your Workplace Picture this: two high-performing employees, both smart, motivated, and experienced, suddenly clash over how decisions should be made, who should speak first in meetings, or what professional communication even means. Sound familiar? These moments aren’t exceptions, they are everyday realities....

- All Post

- Artificial Intelligence

- Coach

- Corporate Training

- DEI

- Education

- Health and Fitness

- Health and Safety

- Leadership

- Marketing

- Mental Health and Wellbeing

- The Human Intelligence

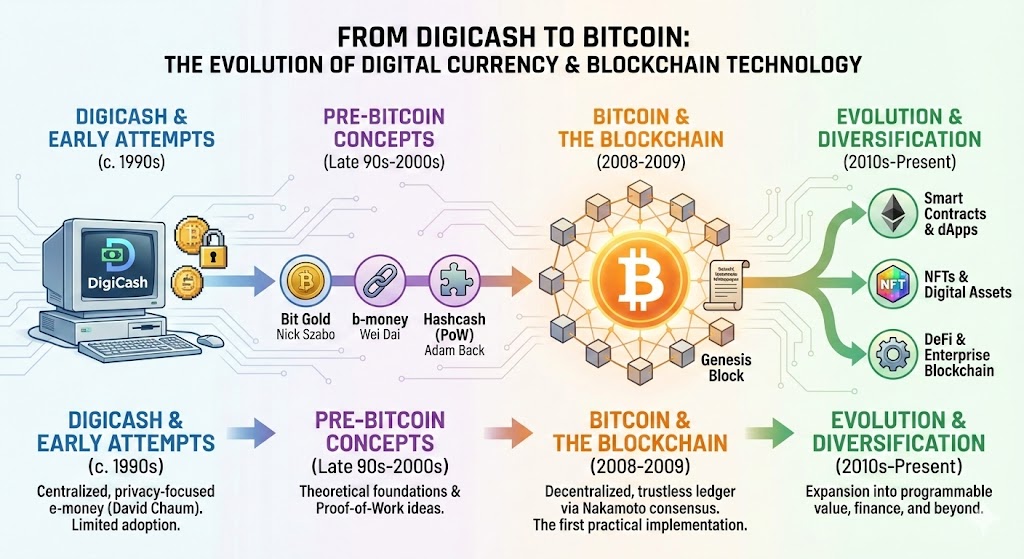

Before Bitcoin became a trend, there was DigiCash, Hashcash, b-money, and Bit Gold, ideas that laid the groundwork for the decentralized financial revolution. In this article, we will walk you through the evolution of digital currency, tying it all to the rise of Bitcoin and blockchain technology. Introduction Before the...

Leadership is no longer just about giving orders or hitting KPIs, it’s about clarity, emotional intelligence, communication, and presence. Whether you’re a team lead, entrepreneur, or aspiring manager, essential leadership training is the foundation for leading with purpose, empathy, and vision. In this post, we’ll explore the key principles and...

If you are feeling stuck, unmotivated, or unsure how to step into your power, you are not alone. But you are also not without solutions. These three transformative online courses from London Intercultural Academy are designed to help you break through barriers, ignite your inner fire, and lead with confidence....

By Hadi Brenjekjy Let’s Be Honest: DEI Feels… Shaky Right Now I remember when companies were tripping over themselves to hire Chief Diversity Officers, slap rainbow logos on their websites, and roll out unconscious bias training like it was free candy. Now?Suddenly, DEI is being labeled as divisive, “woke,” and...

By Hadi Brenjekjy Introduction: Power Is not a Dirty Word When people hear the word power in the workplace, it can bring up some mixed feelings. But power, in the right hands and used the right way, is what gets things moving in any organization. Suppose you are creating a...

Personal branding: marketing guff or an essential tactic in today’s marketplace? By Fenella McCar-thy – Housebrands Toolkits Google personal branding and you will be almost overwhelmed by the amount of information available online. Everybody seems to be talking about the need for a personal brand and how important it is...

Picture this: A top-performing executive is promoted to lead an international team. They have nailed every KPI, managed million-dollar projects, and climbed the corporate ladder like a pro. But six months into the new global role, things fall apart—miscommunication, missed goals, team friction. What went wrong? It wasn’t their technical...

This post will explore the connection between emotional intelligence and effective leadership. We will cover the five key components of EQ (self-awareness, self-regulation, motivation, empathy, and social skills) and offer real-world tips on how leaders can develop each area. The blog will be practical, relatable, and filled with insights that...

Feeling off your game lately? Tired, foggy, or just kinda… bleh? Your nutrition might be the missing puzzle piece. The good news? You don’t have to go full kale-smoothie-mode overnight. Small tweaks can lead to big changes. In this post, we are breaking down 10 super practical, science-backed nutrition tips...

Most Recent Posts

- All Post

- Artificial Intelligence

- Coach

- Corporate Training

- DEI

- Education

- Health and Fitness

- Health and Safety

- Leadership

- Marketing

- Mental Health and Wellbeing

- The Human Intelligence